Ready, Set, Go

Here is where it all begins. A conference call between my Premier Lender and myself to hear your unique scenario to figure out how we can best help you achieve your objectives.

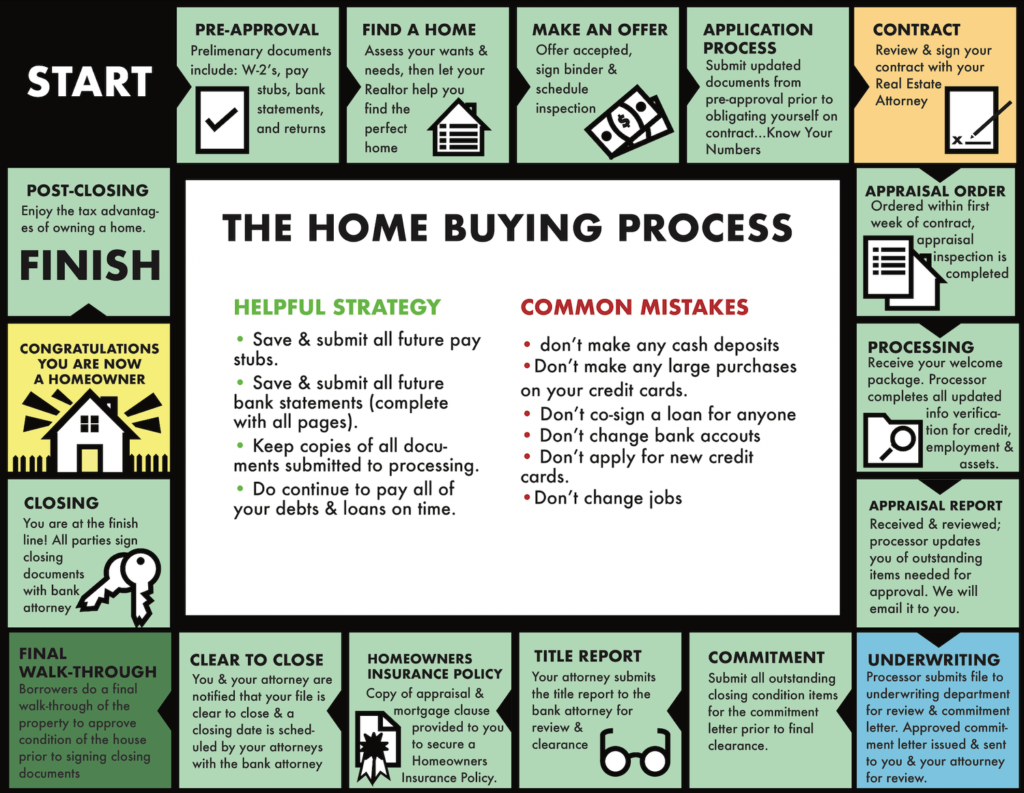

Pre-Approval.

After our preliminary conference call we ask for the following documents.

1 Month Recent Paystubs

Copy of ID & SS Card

2021/2020 W2’s

2021/2020 Tax Returns

2 months Bank Statements (all pages)

Copy of Retirement Account (If Applicable)

Once reviewed, a formal pre-approval package will be sent and reviewed over a second conference call/zoom meeting.

We recommend to have the following:

1. 2 years of work or school history

2. 620+ credit score

3. 7% of the purchase price to cover down payment and closing costs…but this is flexible depending on the loan program we recommend. Some don’t require as much money.

Setting Targets.

It’s important to set expectations from the beginning and I use the word “targets” to help me identify your expectations. I need to know and understand the following targets:

1. Mortgage payment & total funds to close

2. Location

3. Bedroom & bathroom count

Home Shopping.

Here’s the milestone that most people get stuck at. It’s important to stay engaged with the market. I provide a tool to help called One Home that will automatically alert us of new listings that fit our criteria.

Please understand that sellers get savvy with their marketing approaches. Seeing pictures of the property is great, but from experience…sometimes the pictures are completely different than actually being at the property..in both good and bad ways. Every property has a different type of energy and you feel it once you open the door. What i’m trying to say is…let’s be curious and tour property.

Along with One Home, I recommend downloading my MLS(Multiple Listing Service) app to browse and be curious.

Offers

Time to write an offer. Every market is different, from new construction to short sale and actions. Knowing how to write the right offer is key.

Connect with Jose for the best way to write a winning offer

Escrow.

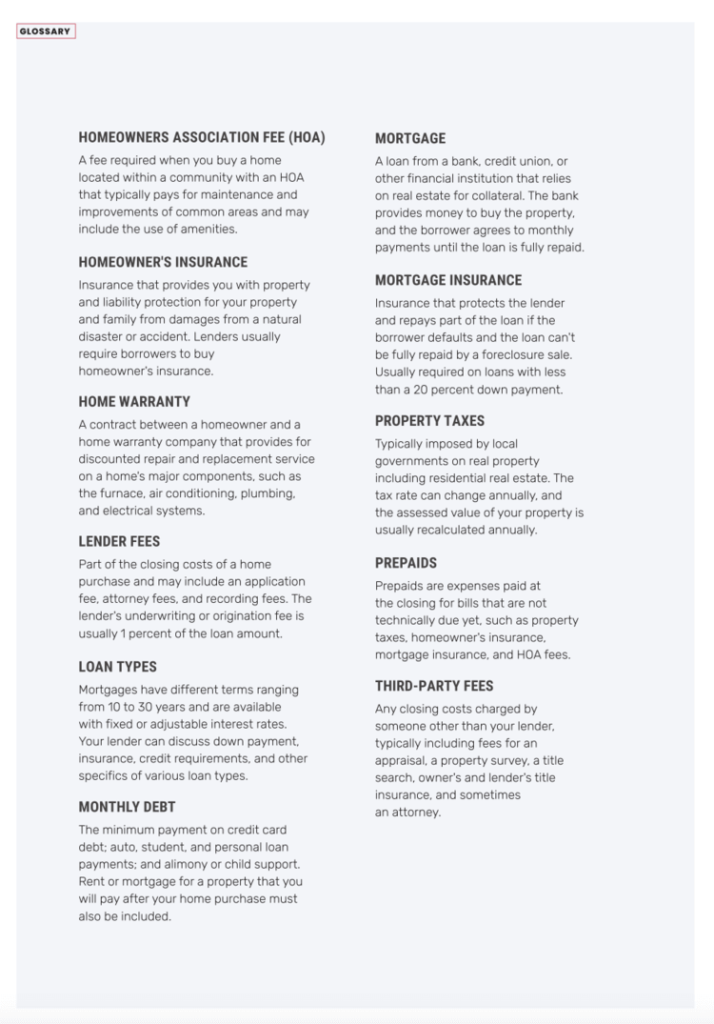

Congratulations! We did it! It’s a team effort between the lender, myself and you to hit this milestone. Escrow is a neutral third party company that assists in processing the transaction for both the seller and us (buyers). Upon opening escrow we will begin to receive escrow instructions

Ernest Money Deposit (EMD)

Home Inspection.

This milestone is to be scheduled between day 1-5 of opening escrow. At the home inspection, we receive a 1 on 1 consultation from a home inspector to help us figure out what’s good and bad about the property.

Home inspections are third party contractors that cost $400+. The cost of the inspection depends on the property’s size.

Appraisal.

Our lender will send us instructions on requesting an appraiser to go out to the property to properly inspect and value it. For single families homes, condo’s and townhomes…appraisers find value by reviewing properties within a 1 mile radius that have sold within the last 90 days…& compare/contrast it to our subject property. If there isn’t a property that has sold within those parameters, they will typically expand the radius.

Appraisers are also a third party contractor, who typically cost $500+ depending on the property’s size and location.

Paperwork.

My team and I will work closely with you to ensure we fill out all of the documentation properly. We will cover loan disclosures, , escrow opening instructions, statement of information, homeowner’s insurance and seller’s disclosures

Loan Approval.

The file has been conditionally approved by our Underwriter. The lending team will be in contact with you to go over the Prior to Doc (PTD) conditions to clear the loan for docs to close.

Clear to Close.

This milestone comes after the underwriter has reviewed all of our documents…from the initial pre-approval package to pay stubs, w2’s, 1099’s, bank statements to appraisal report. An email from our lender will be sent to you that includes a closing disclosure (CD) where you’ll review all of the final numbers for the transaction.

Final walk through

Loan Documents

Escrow contacts you directly to set up an appointment with a notary to schedule a date and time to formally autograph your loan documents to make it official.

Prior to Funding.

Funding & Recording

Once all prior to funding conditions have been met and satisfied, the lender will fund the loan. After funding, the title of the property will be recorded with the county to make it official for closing.

Closing.

Beyond

I provide monthly property value emails to keep you in the know of how much equity you will be gaining over time. I can’t wait for our conversation in 2-5 years when I ask you….”Hey! You have $XXX,XXX in equity…wanna upgrade, down grade, or move closer to work?” On the lending side, the lender will keep you updated on the market for opportunities to refinance…to lower payment, lower rate, removing the MI, and saving money overall.